Rakuten Capital has identified cases of not associated with Rakuten Group, Inc., soliciting investments and other services. Please be vigilant when dealing with any suspicious requests or communications.

About Rakuten Capital

Rakuten Capital is the corporate venture capital arm of Rakuten Group, a global leader in internet services headquartered in Tokyo, Japan.

Launched in 2014, Rakuten Capital invests and operational support to its portfolio companies worldwide. Rakuten Capital has invested globally in more than 70 companies, including Careem, Carousell, GoTo, Lyft, Pinterest and Upstart.

Rakuten Group provides more than 70 services across a wide range of fields, including the following: e-commerce, mobile services, travel, digital content, FinTech services including credit cards, banking, securities, e-money, and cashless payments and professional sports. By seamlessly linking these services through Rakuten membership, we have formed a truly unique “Rakuten Ecosystem.”

- Transformative Business

- Focus on transformative products and technologies especially in the fields of Commerce, Communications, Marketing, Financial Services, Mobility and Healthcare.

- Founder Friendly Support

- With access to Rakuten’s ecosystem of more than 70 services, global businesses and technology expertise across Asia, Europe and the Americas, Rakuten Capital provides financial, operational and strategic support for founders and entrepreneurs.

- Data Friendly Approach

- Utilizing consumer and industry data extensively accumulated within Rakuten’s ecosystem, Rakuten Capital explores a truly unique investment strategy with exceptional support to all of its portfolio companies.

Our Fund(Strategy)

Investing across the IT sector, Rakuten Ventures partners with early and growth-stage startups to build services that can have a lasting impact in an increasingly competitive digital age. Rakuten Ventures combines the objectivity and network of traditional venture funds with the unique access to Rakuten’s global businesses to help portfolio companies unlock the distribution and expertise necessary to stay ahead of the curve.

| Fund Size | US$ 200 Million (Global) JPY 10 Billion (Japan) |

|---|---|

| Sector | Information Technology |

| Stage | Early to Growth Stage |

| Geographic Coverage | Global |

Rakuten FinTech Fund invests in disruptive financial services startups across the world. The fund targets investments in innovative financial services businesses that offer attractive return potential. The FinTech Fund leverages Rakuten’s expertise in financial services, including card and payments services, banking, insurance, securities and asset management to help portfolio companies grow and expand into new markets.

| Fund Size | US $100 Million |

|---|---|

| Sector | Payments, Lending, Asset Management, FX / Remittances, Insurance, Blockchain and other emerging technologies |

| Stage | Early to Mid Stage |

| Geographic Coverage | Global |

Rakuten Global EC Fund invests in e-commerce startups and merchants internationally. The aim of the fund is to create and grow e-commerce businesses together by leveraging data and resources of the Rakuten Ecosystem.

| Sector | EC (Manufacturers, Wholesalers, Retailers, Marketplace Operators, C2C platforms and more) |

|---|---|

| Stage | Early to Late Stage |

| Geographic Coverage | Global |

Rakuten Mobility Investment focus on disruptive ridesharing startups and mobility platforms across the world. The investment platform targets early to late stage investments in innovative companies that offer attractive return potential.

| Sector | Mobility |

|---|---|

| Stage | Early to Late Stage |

| Geographic Coverage | Global |

Rakuten Strategic Investment focuses on transformative startups who potentially have game changing technology or products and demonstrate strategic synergies to Rakuten’s global ecosystem. Rakuten Capital commits to provide startups with strategic support to grow further and faster, which could also aid in expanding the Rakuten ecosystem.

| Stage | Growth Stage |

|---|---|

| Geographic Coverage | Global |

TEAM

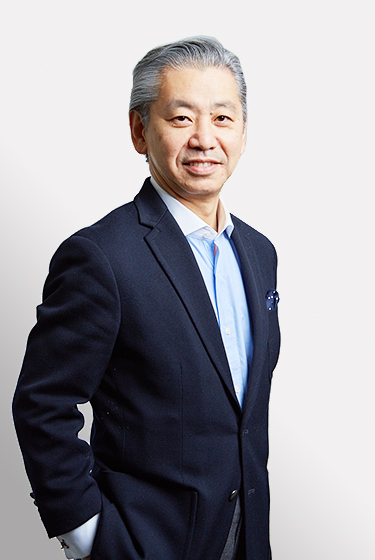

President / Managing Partner

-

more

Hiroshi TakasawaGroup Executive Vice President of Rakuten Group, Inc.Hiroshi TakasawaGroup Executive Vice President of Rakuten Group, Inc.

Hiroshi TakasawaGroup Executive Vice President of Rakuten Group, Inc.Hiroshi TakasawaGroup Executive Vice President of Rakuten Group, Inc.

Senior Vice President of FinTech Group Company

President of Investment & Incubation Company

Hiroshi is President of the Investment & Incubation Company, where he is responsible for leading Rakuten Capital various investment funds, including Rakuten Ventures, Rakuten FinTech Fund, Rakuten Global EC Fund, Rakuten Mobility Investment and Rakuten Strategic Investments.

Hiroshi joined Rakuten in 2005 and established Rakuten Strategic Partners, a private equity investment platform with which he actively engaged in venture investments, buyout investments and other M&A-related transactions. He has also held a number of executive and key positions, such as President of Rakuten Securities Holdings, Chairman of Rakuten Investment Management, President of Rakuten Life Insurance, and CEO of Rakuten Asia Pte. Ltd.

Prior to joining Rakuten, Hiroshi worked at Nomura Securities, Nomura Securities International (NY) and GMAC Commercial Mortgage Japan, managing various investments and financial products. He is a member of the Japanese Association of Turnaround Professionals. -

more

Oskar Mielczarek de la MielFinTech Fund/Mobility InvestmentsOskar Mielczarek de la MielManaging Partner, Rakuten FinTech Fund

Oskar Mielczarek de la MielFinTech Fund/Mobility InvestmentsOskar Mielczarek de la MielManaging Partner, Rakuten FinTech Fund

Senior Executive Officer of Rakuten Group, Inc.

Oskar is the Managing Partner in charge of Rakuten’s growth venture investments in industries such as Fintech, Mobility, Digital Media, and Healthcare.

Previously, Oskar acquired extensive investment, advisory and operational experience in the financial industry, including banking at JP Morgan and Merrill Lynch, private equity and retail financial services in North America and Europe. Oskar is responsible for Rakuten’s mobility investments, including ride-sharing leaders Lyft and Careem, as well as leading on-demand delivery leader Glovo.

Other key investments sourced include Fintech disruptors such as BlueVine, Upstart, Azimo, Currencycloud, and Acorns among others. Recent investments include Fever, a millennial data-driven entertainment curation platform.

Oskar earned his MBA at Harvard Business School and BA at ICADE in Spain.

Members

-

more

Hiromichi AokiPlanning & Strategic InvestmentHiromichi AokiSenior Partner, Planning & Strategic Investment

Hiromichi AokiPlanning & Strategic InvestmentHiromichi AokiSenior Partner, Planning & Strategic Investment

General Manager of Rakuten Group, Inc.

Hiromichi is General Manager in charge of strategy and planning of Rakuten Capital.

Prior to joining Rakuten, Hiromichi had extensive experience in investment banking, private equity and asset management at Nomura in New York, Tokyo, London and Hong Kong.

Hiromichi earned BA in Commercial Science at Hitotsubashi University in Tokyo, Japan -

more

Alec FujiiFinTech Fund/Mobility InvestmentsAlec FujiiFinancial Analyst, Rakuten FinTech Fund/Rakuten Mobility Investments

Alec FujiiFinTech Fund/Mobility InvestmentsAlec FujiiFinancial Analyst, Rakuten FinTech Fund/Rakuten Mobility Investments

Alec is a Financial Analyst for Rakuten Fintech Fund. He is responsible for providing analytical and business support to the Fund’s respective portfolio companies, as well as sourcing and the due diligence for new opportunities.

Alec earned his BA degree at Brown University, double concentrating in Applied Mathematics-Economics and Engineering. -

more

Regina HoRakuten VenturesRegina HoSenior Associate, Rakuten Ventures

Regina HoRakuten VenturesRegina HoSenior Associate, Rakuten Ventures

Regina is a Senior Associate at Rakuten Ventures. In this role, she provides analytical and business development support to portfolio companies and contributes to the sourcing and due diligence processes of new investment opportunities.

Regina earned a bachelor’s degree in Business Administration from the National University of Singapore. -

more

Nicole JangRakuten VenturesNicole JangPartner, Rakuten Ventures

Nicole JangRakuten VenturesNicole JangPartner, Rakuten Ventures

Nicole is a Partner at Rakuten Ventures and is responsible for investment in Japanese startups. She has experiences in strategic consulting and financial institutions such as Deutsche Bank, HSBC and Bank of America in Korea and US.

Nicole earned her BA at University of Southern California, Los Angeles. -

more

Michael PiechalakFinTech Fund/Mobility InvestmentsMichael PiechalakPartner, Rakuten FinTech Fund/Rakuten Mobility Investments

Michael PiechalakFinTech Fund/Mobility InvestmentsMichael PiechalakPartner, Rakuten FinTech Fund/Rakuten Mobility Investments

Michael is a partner at Rakuten Fintech Fund, based in the U.S. He leads investments in international fintech and mobility startups. Including projects within the Corporate Development Department of Rakuten, he has completed over 15 deals since joining the company in 2014. Prior to joining Rakuten, Michael spent over 10 years in private equity and investment banking positions with firms in the U.S. including H.I.G. Capital and Lehman Brothers. Michael earned his MBA at Duke University and his undergrad degree at Northwestern University. -

more

Hajime SakoEC FundHajime SakoSenior Associate, Global EC Fund

Hajime SakoEC FundHajime SakoSenior Associate, Global EC Fund

Hajime is in charge of due diligence processes of new investment opportunities and providing support to portfolio companies.

Prior to joining Rakuten Global EC Fund, He worked in the Marketplace business as an EC Consultant.

Hajime earned BA at Waseda University, in Tokyo, Japan. -

more

Shoichiro SuzukiEC FundShoichiro SuzukiSenior Partner, Rakuten Global EC Fund

Shoichiro SuzukiEC FundShoichiro SuzukiSenior Partner, Rakuten Global EC Fund

General Manager of Rakuten Group, Inc.

Shoichiro is Senior Partner at Rakuten Global EC Fund, based in Singapore. He leads venture investments in global startups and synergy creation with Rakuten ecosystem.

Prior to joining Rakuten, Shoichiro had over 10 years of experience in building start-ups (as co-founder), open innovation, and corporate venture investment.

Shoichiro earned his MBA with Honors at The University of Chicago and BA in Economics at The University of Tokyo. -

more

Adit SwarupRakuten VenturesAdit SwarupPartner, Rakuten Ventures

Adit SwarupRakuten VenturesAdit SwarupPartner, Rakuten Ventures

Adit is based in Singapore and his areas of focus include artificial intelligence, consumer technology, and digital media. He currently serves as a board member for Carousell, and ViSenze. Prior to joining Rakuten Ventures, Adit worked in the corporate legal function, restructuring and turnaround industry, and capital markets, bringing more than $2.5 billion worth of deals in transaction experience.

Adit earned his Bachelor of Commerce, specialising in Finance and Economics, at McGill University. -

more

Shotaro YamanakaPlanning & Strategic InvestmentShotaro YamanakaInvestment Manager, Planning & Strategic Investment

Shotaro YamanakaPlanning & Strategic InvestmentShotaro YamanakaInvestment Manager, Planning & Strategic Investment

Shotaro is Investment Manager working for investment activities and business alliance between startups and Rakuten's businesses.

After Citibank and Morgan Stanley, he joined CEO office in Rakuten and has been leading business development and value up activities with startups and other business units.

Shotaro earned a master's degree in Finance from London Business School. -

more

Yuto ToyamaRakuten VenturesYuto ToyamaSenior Associate, Rakuten Ventures

Yuto ToyamaRakuten VenturesYuto ToyamaSenior Associate, Rakuten Ventures

Yuto is a Senior Associate at Rakuten Ventures. In this role, he provides analytical and value-up support to portfolio companies and contributes to the sourcing and due diligence processes of new investment opportunities.

After working in Japan & Vietnam at Taiheiyo Cement, he joined Incubation business department in Rakuten and has been leading new business development and PMO activities.

Yuto earned MBA at Singapore Management University and BA in Commerce at Waseda University in Tokyo, Japan.

PORTFOLIO

NEWS

Rakuten Global EC Fund invests in Tokyo-based DIY E-commerce company "DAITO".

Rakuten Global EC Fund invests in U.S. based next-generation lithium-ion batteries development company "TeraWatt".

Rakuten Ventures invests in Tokyo-based wellness service SaaS company "hacomono".

Rakuten Global EC Fund invests in Tokyo-based D2C wellness company "TENTIAL".

Rakuten Strategic Investments invests in Tokyo-based Digital Comics Production company "Toon Cracker".

Rakuten Strategic Investments invests in Singapore-based Web3 GameFi platform company "DEA".

Rakuten Ventures invests in Tokyo-based Healthcare platform company "Ubie".

Rakuten Ventures invests in Indonesia-based D2C Vegan Skin Care company "BASE".

Rakuten Global EC Fund invests in Tokyo-based Circular economy promoter company "JEPLAN".

Rakuten Ventures invests in Korea-based D2C Jewelry company "Bejewel".

Rakuten FinTech Fund invests in U.S.based ESG impact analysis "Proof of Impact".

Rakuten Global EC Fund invests in India-based Pay with Reward Fintech company "Twid".

Rakuten Global EC Fund invests in Tokyo-based Telemedicine company "Aimed".

Rakuten Ventures invests in Tokyo-based Map Engine Optimization company "mov".

Rakuten Global EC Fund invests in LATAM-based reward program, cashback, and Fintech company "Leal".

Rakuten Ventures invests in Tokyo-based Pet Wellness company "Petokoto".

Rakuten Strategic Investments invests in Tokyo-based Real Estate Tech company "SYLA".

Rakuten Ventures invests in Singapore-based D2C sneaker company "Cariuma".

Rakuten Ventures invests in Singapore-based FinTech company "Honest Bank".

Rakuten Ventures invests in Tokyo-based B2B online fresh food aggregator company "Secai Marche".

Rakuten Strategic Investments invests in Tokyo-based Edge AI camera solution company "AWL".

Rakuten Capital invests in U.S.based Mobile Tech company "Robin io".

Rakuten Ventures invests in Singapore-based Mobile Tech company "Airalo".

Rakuten Ventures invests in UK-based Food Tech company "Taster".

Rakuten Ventures invests in U.S.based e-commerce company "Verishop".

Rakuten Global EC Fund invests in SEA based budget hotel chain “RedDoorz”.

Rakuten Capital leads $35 million investment in social event discovery platform Fever.

Rakuten Global EC Fund invests in Singapore based cashback service “ShopBack”.

Rakuten Ventures invests in a UI/UX analytics and consulting company, Uncover Truth.

Rakuten Ventures invests in membership based e-commerce platform, Black Fish.

Rakuten Ventures invests in corporate food subscription and delivery service, Okan.

Rakuten Capital invests in New York based big-data funding platform and advisory “Cyndx”

Rakuten Capital leads $20 million Series C investment in UK-based online remittance player “Azimo”

Rakuten Capital invests in Tokyo-based the change investment application provider "Toranotec".

California-based fintech payment company “Wepay” was acquired by J.P.Morgan.

Rakuten FinTech Fund invests in London-based premium finance software “PremFina”.

Rakuten invests in Barcelona-based on-demand delivery service “Glovo”.

Rakuten Global EC Fund invests in Tokyo-based bedding manufacture “airweave”.

Rakuten Global EC Fund invests in Tokyo-based genetic health company “Genesis Healthcare”

Rakuten FinTech Fund invests in Switzerland-based mobile healthcare company “dacadoo”

Rakuten Ventures invests in Tokyo-based data technology company “from scratch.”

Rakuten FinTech Fund invests in Berlin-based InsurTech company “Simplesurance.”

Rakuten FinTech Fund makes additional investment in London-based fintech SaaS company “Currency Cloud.”

Rakuten FinTech Fund invests in California-based fintech lending company “Upstart.”

Rakuten FinTech Fund invests in Tokyo-based fintech asset management company “Folio.”

CONTACT

ACCESS

Rakuten Europe S.a.r.l. (Luxembourg)

2, Rue du Fosse

1536 Luxembourg

※Click ![]() to open a detailed map

to open a detailed map

Rakuten Crimson House West (USA)

Rakuten Crimson House West 800 Concar Dr.,

San Mateo, California, 94402

※Click ![]() to open a detailed map

to open a detailed map

Rakuten Crimson House East(Singapore)

138 Market Street #32-01, CapitaGreen,

Singapore 048946

※Click ![]() to open a detailed map

to open a detailed map

Rakuten Crimson House

(Tokyo)

158-0094

Rakuten Crimson House, 1-14-1

Tamagawa, Setagaya-ku, Tokyo

※Click ![]() to open a detailed map

to open a detailed map

※Click ![]() to open a detailed map

to open a detailed map